RBI raises repo rate to 4.9%; GDP growth estimate for FY23 at 7.2

Published On: Wednesday, June 8, 2022 | By: Team KnowMyStock

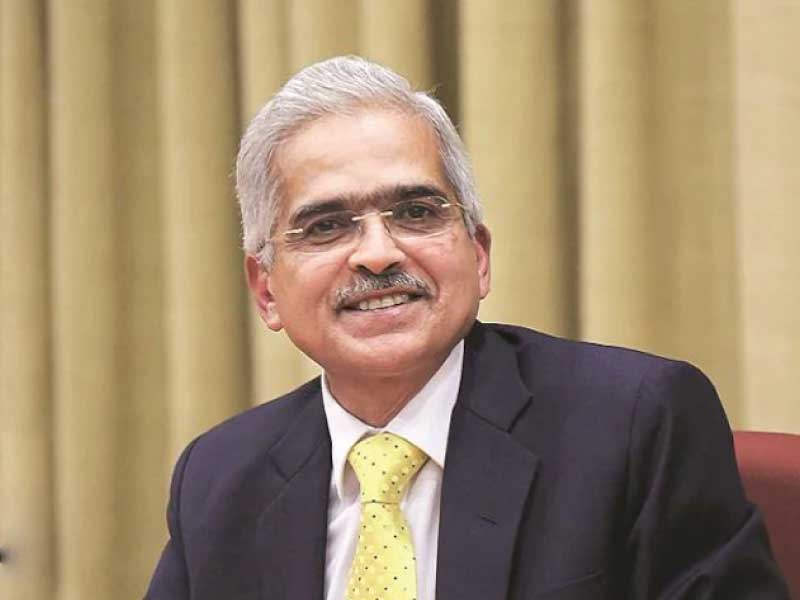

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) today(8 June 20 22) raised the repo rate by 50 basis points to 4.9 percent (bps), citing inflation concerns. It has also decided to remain focused on the withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth. The committee has decided to retain the GDP growth estimate for FY23 at 7.2 percent, said RBI Governor Shaktikanta Das. On the assumption of a normal monsoon in 2022 and average crude oil price of $105 per barrel, inflation is projected at 6.7 percent in 2022-23, with Q1 at 7.5 percent; Q2 at 7.4 percent; Q3 at 6.2 percent; and Q4 at 5.8 percent, with risks evenly balanced.

According to the RBI MPC, the global economy continues to grapple with multi-decadal high inflation and slowing growth, persisting geopolitical tensions and sanctions, elevated prices of crude oil and other commodities and lingering Covid-19 related supply chain bottlenecks.

The MPC noted that, in such a challenging global environment, domestic economic activity is gaining traction, while inflation pressures have intensified further.

The Governor said the inflation likely to remain above upper tolerance band for three quarters of this financial year. The CPI inflation forecast for FY23 increased to 6.7 per cent from 5.7 per cent.

"To further facilitate recurring payments like subscriptions, insurance premia, education fee, etc. of larger value under the framework, the limit is being enhanced from Rs 5,000 to Rs 15,000 per transaction," said Das.

The MPC has also proposed to allow linking of credit cards on the UPI platform.

We are on Telegram!

JOIN our telegram channel to receive updates on Financial News and Stock and FNO Tips.

Click Here!

Follow Us On: